iowa income tax withholding calculator

If you make 55000 a year living in the region of Florida USA you will be taxed 9076That means that your net pay will be 45925 per year or 3827 per month. The amount of income you earn.

Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period.

. Estimate your federal and state income taxes. 2022 W-4 Help for Sections 2 3 and 4. Paycheck Withholding Tax Refund Estimate Home and Mortgage Calculators Cars and Car Loan Calculators Retirement Calculators Loan Calculators Savings Calculators Energy Savings Family Finances College.

The Iowa Department of Revenue used gallon totals from the Iowa Fuel Tax Monthly Report to determine tax rates for motor fuel and special fuel. This would increase your paychecks next year and help balance your next tax return tax refund. It depends on.

Beginning July 1 2020 the. Income Withholding for 2022. Iowa collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

2021 Tax Calculator to Estimate Your 2022 Tax Refund. This 110k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Iowa State Tax tables for 2022The 110k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Iowa is used for calculating. Maryland has eight marginal tax brackets ranging from 2 the lowest Maryland tax bracket to 575 the highest Maryland tax bracket.

Your average tax rate is 212 and your marginal tax rate is 396This marginal tax rate means that your immediate additional income will be taxed at this rate. Check your eligibility for a variety of tax credits. Free Federal and State Paycheck Withholding Calculator.

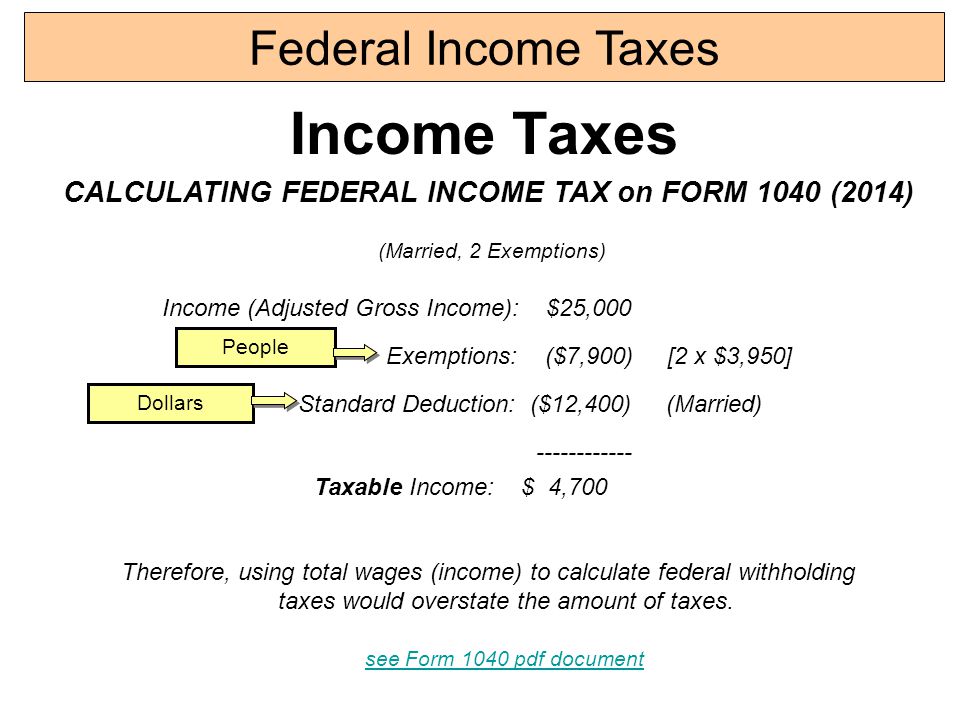

Calculate your expected refund or amount of owed tax. Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate. US Tax Calculator and alter the settings to match your tax return in 2022.

Both Marylands tax brackets and the associated tax rates were last changed ten years prior to 2020 in 2010. If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer. Were proud to provide one of the most comprehensive free online tax calculators to our users.

However now or in early 2022 we suggest you reduce your per paycheck tax withholding. Unlike the Federal Income Tax Iowas state income tax does not provide couples filing jointly with expanded income tax brackets. If you make 55000 a year living in the region of California USA you will be taxed 11676That means that your net pay will be 43324 per year or 3610 per month.

You can use this tax calculator to. Each allowance you claim reduces the amount withheld. Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a.

Now you can easily create a Form W-4 that reflects your planned tax withholding amount. Enter annual income from highest paying job. IDR has issued new income withholding tax tables for 2022 including an updated withholding calculator.

The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you. Each marginal rate only applies to earnings within the applicable marginal tax bracket. Iowas maximum marginal income tax rate is the 1st highest in the United States ranking directly below Iowas You can learn more about how the.

Fields notated with are required. How many withholding allowances you claim. Your average tax rate is 165 and your marginal tax rate is 297This marginal tax rate means that your immediate additional income will be taxed at this rate.

In Maryland different tax brackets are. If you withhold at the single rate or at the lower married rate. 2021 2022 Paycheck and W-4 Check Calculator.

Form 8960 Net Investment Income TaxIndividuals Estates and Trusts.

Calculating Withholding Allowances Contractor Licensing Blog

Income Tax Calculator Estimate Your Refund In Seconds For Free

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Federal State Payroll Tax Rates For Employers

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

W4 Form Tax Withholding For Irs And State Income Taxes

Iowa Paycheck Calculator Smartasset

Tax Withholding For Pensions And Social Security Sensible Money

Should You Move To A State With No Income Tax Forbes Advisor

Tax Calculator Estimate Your Taxes And Refund For Free

Massachusetts Income Tax Rate And Brackets 2019

Income Tax Calculator 2021 2022 Estimate Return Refund

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Calculating Federal Income Tax On Form 1040 2014 Ppt Video Online Download

Income Tax Calculator 2021 2022 Estimate Return Refund

How Do State And Local Individual Income Taxes Work Tax Policy Center

Lili S Tax Resources Tools And Tips To Simplify Tax Season Lili Banking